Creativity is flying in any direction that your flight of imagination takes you. It is the freedom to be “stupid”.

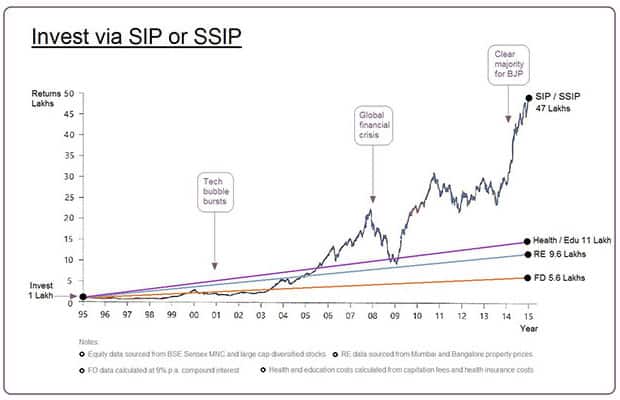

Save Invest and Enjoy

We offer many investment options like direct equity investments, mutual funds, both debt and equity, REITs (Real Estate Investment Trusts), INViTs (Infrastructure Investment Trusts), Commodities, Capital Gains Bonds, Tax Free Bonds, Corporate Debentures/Bonds and Deposits with RBI registered NBFCs. Apart from these, we also advice on special investment schemes for senior citizens which are safe and tax efficient, such as the Varishtha Vaya Vandana Yojana.

For the Financially savvy HNIs, where appropriate, we advise on hedging arrangements through strategies like “cashless collars” or, on exploiting arbitrage opportunities with minimum risk in the derivative (futures & options) segment of the Exchanges. We also help them in securing recurring income using covered calls and puts, while attempting to minimize risk while doing so.

Golden Rules of Investment

Why use our Investment services

- We are tied up with many investment companies to create the proper portfolio to accomplish your investment goals.

- A team of experienced investment professionals who will act as your guide to all we have to offer. They can answer your questions, make transactions, and help you learn about all of the products and services available to you.

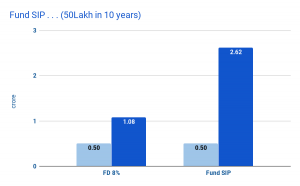

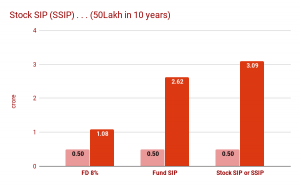

What is Mutual Fund

Mutual Funds are collective investment vehicles which diversify risks and bring expertise and research within reach of the ordinary investors. They are regulated by Securities and Exchange Board of India (SEBI).

Frequently asked questions

The sooner you start the better. Guidelines to follow for making wise investments:

- Set your objectives.

- Do your homework before investing. It is risky to rely on pure luck when making an investment.

- Ask yourself whether you want to invest or speculate. For investment, make sure you have a cut-off point in mind to protect your bottom line. In the case of speculation, don’t make investment decisions out of panic when the market becomes volatile.

- Invest as much as you can afford, but no more.

- Don’t leave money lying around in non-interest bearing accounts except as stand-by cash. Make sure your investment portfolio gives you a big enough return to beat inflation.

- Always use a reputable investment firm or financial institution.

- Diversify. Invest internationally and spread your investments over a range of low, medium and high-risk products in order to hedge against losses.

- Make sure you understand exactly what risks are involved with every investment you make. If in doubt, seek professional advice.

- Keep an eye on your investments. Take opportunities and shift products if it is beneficial to do so.

With your objectives in mind, determine how much risk you’re prepared to take. Do you want to adopt a conservative, moderate or aggressive investment strategy? Ask yourself the following questions before you make your decision:

-

- Are you prepared to make long-term investments, which will allow you to take greater risks for higher returns ?

- If you’re going for short-term, high-risk investments, can you afford to lose some of the money you invest ?

- If you’re married with children, what level of risk can you take and still be certain of their future ?

- You’re going to diversify by spreading your investments over a range of low- to high-risk products. But will you weigh them towards high- or low-risk investments ?

- If you want your money to be safe, will you be content with a moderate rate of return ?

- If you opt for safe investments, will the returns be enough to cover inflation ?

- To know your own Investor Profile check Questionnaire

Stock prices and Mutual Fund prices are quoted in the newspapers and on the Internet. They are also available on websites of most Mutual Funds and research agencies. In order to maximize the money you invest, it is necessary to review your investment portfolio on a regular basis. You may want to re-look at your investments to account for changing goals, fresh investment avenues, changing market dynamics etc. It is possible that some investments you are holding are not performing to your expectations. If that is the case, you may consider revising your portfolio.

Some Observations on Financial Planning

Disclaimer

Apart from drawing on our own knowledge and experience, we also consult auditors and legal practitioners with whom we are tied, while seeking optimum solutions to our clients’ financial needs. But we wish to state that we are not a SEBI registered investment adviser. The following sections attempt to provide a flavor of the financial planning process so that the clients can dovetail their investments to their goals rather than undertake them in an unplanned, haphazard manner. Clients who require further advice on financial planning may approach a registered investment adviser.

If you don’t plan, your story might be the same as given below. It is never too early to start.

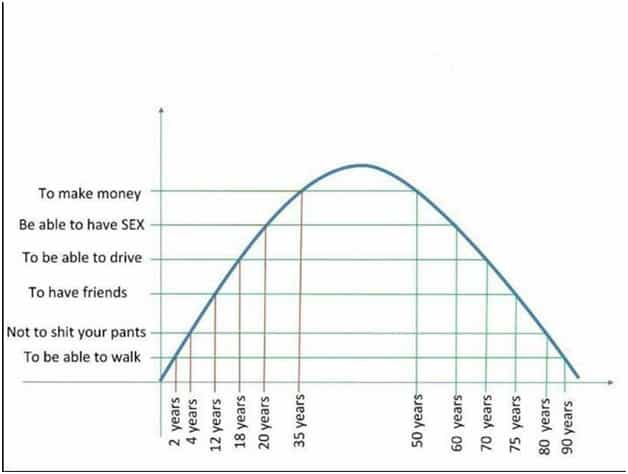

Age

Age is an important factor to bear while crafting your financial plan.

Finally, in spite of meticulous planning one needs the wisdom to accept life as it comes since there are some things that no amount of planning can change.

What does success mean?

A financial plan has to also include clear procedure for deployment of accumulated corpus at various stages through withdrawals/payments, transfers, gifts, annuities, will, tax efficient trusts etc.

What is investment?

An investment must answer the following four questions:

- Why is the investment considered (Goal)

- When does the investment mature or has to be liquidated(Time Horizon)

- What is the return expectation (Yield)

- What is the risk that is taken (Risk)

Why Financial Plan

- It Helps Us to Know Where We Stand at Present

- It Helps Us to Determine and prioritize Our Goals

- It Provides Options How to Reach Our Goals

- It Helps us Know What is Possible and What is Not

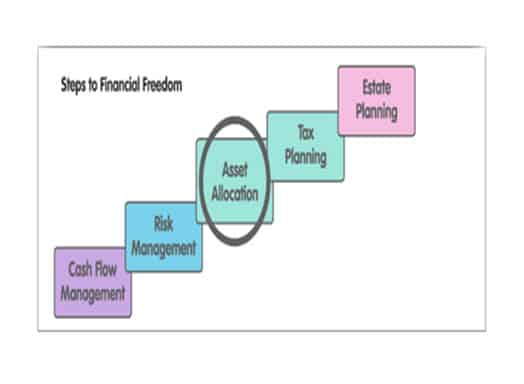

Steps in Financial Planning

Of critical importance in the process of financial planning is knowledge of self. A thorough understanding of one’s risk profile, family aspirations and anxieties, control over emotions and biases is essential for designing and executing an effective financial plan.

We would strongly urge that the clients complete the Questionnaire as objectively as possible to asses at her/his Investor profile.

Well, we just traversed broad contours of financial planning. But a comprehensive plan apart from having to reckon with meticulous listing and prioritizing of goals over time, will have to answer numerous questions during its formulation, such as;

- How do we inflation proof a financial plan?

- What is the return required on a monthly savings plan of say, Rs 15000/- over 20 years to accumulate a retirement corpus of Rs. 2 crores?

- What will be the ideal asset class or a combination of assets where investments would have to made to achieve the above objective?

- What is the optimum extent of exposure to real estate in one’s financial plan? Is there a role for Gold while considering asset allocation?

- How long is long term for equity related investments?

- What are the tax efficient investment avenues?

- What are the options available while considering Estate Planning and what precautions one has to take?